ETH Price Prediction: $5,210 Target in Sight as Bulls Dominate

#ETH

- Technical Breakout: ETH price surpasses key moving averages and Bollinger Band resistance.

- Institutional FOMO: $24.5B+ inflows signal long-term confidence in Ethereum's utility.

- Macro Sentiment: Altseason momentum and Vitalik's advocacy balance leverage risks.

ETH Price Prediction

Ethereum Technical Analysis: Bullish Indicators Emerge

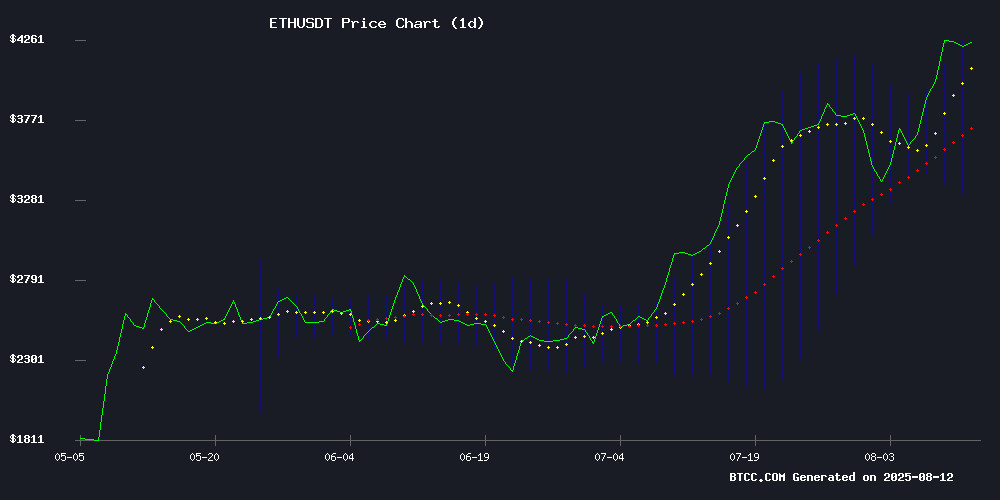

According to BTCC financial analyst Robert, ethereum (ETH) is currently trading at $4,494.60, significantly above its 20-day moving average (MA) of $3,834.53, indicating strong bullish momentum. The MACD histogram shows a positive crossover at 7.24, reinforcing the upward trend. Additionally, the price is testing the upper Bollinger Band at $4,391.67, which often acts as a resistance level. A sustained break above this level could propel ETH toward new highs.

Institutional Demand and Bullish Sentiment Drive Ethereum Rally

BTCC financial analyst Robert highlights that Ethereum is benefiting from massive institutional buying, with headlines like Pantera Capital's endorsement and BitMine's $24.5B stock offer signaling strong confidence. News of Ethereum breaking $4K and targeting $7K, alongside Coinbase's institutional demand surge, suggests a robust altseason. However, Robert cautions that Vitalik Buterin's warnings on leverage and open-source advocacy may introduce volatility amid the euphoria.

Factors Influencing ETH’s Price

Ethereum Price Targets $5,210 Amid Massive Institutional Buying

Ethereum surged to $4,290 as institutional heavyweights Bitmine and SharpLink accumulated billions worth of ETH. Bitmine now holds 1.2 million tokens ($5 billion), while SharpLink controls 598,800 ETH ($2.5 billion).

Derivatives volume spiked 30% to $142 billion, reflecting heightened speculative interest. Analysts project a breakout toward $5,210, with $6,946 possible if momentum sustains.

The asset's 1.18% daily gain accompanies $85.3 billion in 24-hour trading volume, pushing its market capitalization to $517.85 billion. Institutional accumulation suggests growing conviction in Ethereum's long-term valuation.

BitMine’s $24.5B Stock Offer Tests Vitalik’s Warning on ETH Leverage

BitMine Immersion Technologies has aggressively expanded its at-the-market stock offering to $24.5 billion, signaling a corporate rush into Ethereum accumulation despite Vitalik Buterin’s caution against overleveraged ETH treasuries. The Delaware-based firm, chaired by Fundstrat’s Tom Lee, now holds 1.15 million ETH—surpassing peers like SharpLink and The Ether Machine.

Ethereum’s price surged 5.4% following BitMine’s SEC filing, reflecting bullish institutional demand. Proceeds from the offering, facilitated by Cantor Fitzgerald, are earmarked for further ETH purchases, debt repayment, and acquisitions. The move underscores a growing divergence between Buterin’s philosophical warnings and corporate treasury strategies in a heated market.

Coinbase Poised to Capitalize on Institutional Ethereum Demand as Alt Season Surges

Ethereum's resurgence is driving a broader altcoin rally, with institutional interest accelerating since Circle's successful IPO in early June. Bernstein analysts note ETH has gained 80% since June 5, 2025, recently breaching $4,000 for the first time in eight months.

"This is textbook alt season dynamics," says Gautam Chhugani of Bernstein. The firm identifies Coinbase as a primary beneficiary, with ETH's rally boosting trading volumes, staking revenue, and ecosystem activity across decentralized finance platforms like Aave.

Ethereum's dominance in stablecoin issuance—highlighted by Circle's public listing—is creating a virtuous cycle. The cryptocurrency currently holds a $529.65 billion market cap as it stabilizes near $4,186 after briefly touching $4,350.

FG Nexus Accelerates ETH Accumulation, Eyes Leading Stake in Network

FG Nexus, the digital assets division of Fundamental Global Inc., has made a decisive entry into Ethereum with a $200 million purchase of 47,331 ETH. The acquisition, executed at an average price of $4,228.40 per token, marks the beginning of an aggressive strategy to secure a 10% stake in Ethereum's circulating supply. The firm's positioning among the largest corporate ETH holders underscores institutional confidence in the asset's long-term value.

The Charlotte-based company initiated its accumulation on July 30 with a symbolic 6,400 ETH purchase, timed to coincide with Ethereum's 10-year genesis block anniversary. Subsequent purchases were funded entirely by proceeds from a $200 million private placement, demonstrating committed capital deployment.

FG Nexus plans to leverage its growing ETH reserves through staking and restaking strategies, with 'ETH Yield per share' established as a core shareholder metric. Beyond direct holdings, the firm aims to serve as a gateway to Ethereum-based financial products, bridging traditional finance with decentralized protocols.

Ethereum Breaks $4K Amid Bullish Momentum, Eyes $7K Target

Ethereum's price surge past $4,000 has reignited bullish sentiment across crypto markets, with technical indicators suggesting potential for further gains toward $7,000. The second-largest cryptocurrency by market capitalization recorded a 19% weekly increase, peaking at $4,329—its highest level since December 2021.

Institutional inflows and record ETF activity underscore growing confidence in ETH. Open interest in futures contracts approaches all-time highs while corporate treasuries accumulate the asset at unprecedented rates. The 50-day moving average's crossover above the 200-day MA reinforces the technical bullish case.

Market participants debate whether this marks the beginning of a sustained rally or precedes a correction. With ETH now just 12% below its November 2021 all-time high of $4,878, the breakout from a multi-year megaphone pattern has captured trader attention across major exchanges.

Pantera Capital Highlights Digital Asset Treasury Companies as Emerging Investment Vehicle

Digital Asset Treasury (DAT) companies are gaining traction as a novel investment mechanism, with Pantera Capital leading the charge. These entities focus on enhancing net asset value per share through yield-generating strategies in digital assets, rather than passive holdings. Pantera has deployed over $300 million across DATs, leveraging market conditions to optimize returns.

BitMine Immersion (BMNR) stands out as a prime example, holding 1.15 million ETH—valued at $4.9 billion—making it the largest Ethereum treasury globally. Its stock liquidity rivals top U.S. equities, averaging $2.2 billion in daily trading volume. Ethereum's foundational role in this ecosystem underscores its strategic importance for DATs.

BitMine Targets $20B Raise to Boost Ethereum Holdings

BitMine, a leading institutional holder of Ethereum, has revised its fundraising ambitions upward in a bold move to solidify its position in the crypto market. The firm now seeks to raise $24.5 billion through a Common Stock offering—$20 billion of which was announced in its latest filing. This capital injection will be directed toward expanding its ETH treasury, signaling strong corporate conviction in Ethereum's future.

The breakdown reveals a strategic accumulation of funds: $2 billion from the current prospectus combines with $2.5 billion from prior filings. Such aggressive accumulation of Ethereum underscores a broader trend of institutional players anchoring their long-term strategies to ETH's ecosystem. Market observers note this as a watershed moment for institutional crypto adoption.

Vitalik Buterin Advocates for Open Source as a Solution to Tech Inequality

Ethereum co-founder Vitalik Buterin underscores the critical role of open-source technology in addressing systemic power imbalances and access disparities in the tech sector. His argument centers on preventing emerging innovations—from life extension to genetic enhancements—from becoming exclusive privileges of the wealthy.

"I support it only if it's open source" should become a defining ethos, Buterin asserts. The transparency and adaptability of open-source models democratize development, allowing global participation irrespective of economic or geographic barriers. This approach could mitigate risks of entrenched underclasses in an increasingly tech-driven world.

Ethereum Bulls Drive ETH Toward New Highs Amid Strong Market Support

Ethereum's resilience shines as it rebounds from critical support levels, with bullish momentum propelling prices firmly above $4,200. The cryptocurrency now eyes a potential ascent to $4,500, fueled by sustained buying pressure and favorable technical indicators.

A swift recovery from this week's dip to $3,950 demonstrates robust demand, with ETH outperforming Bitcoin in recent sessions. The asset has now challenged the $4,362 resistance level after clearing successive barriers at $4,150 and $4,250.

Technical foundations strengthen as ETH maintains its position above key moving averages. The 100-hour SMA and a rising trend line near $4,250 create a solid base for further gains. Momentum indicators tell a consistent story—the RSI holds above neutral territory while the MACD continues flashing bullish signals.

Traders now watch for a decisive break above $4,320, which could open a path toward $4,400 and beyond. Market participants appear ready to test higher ground, with $4,500 emerging as the next significant target should current momentum persist.

Vitalik.eth.limo Explores Idea-Driven vs. Data-Driven Approaches in Decision-Making

Vitalik.eth.limo examines the dichotomy between idea-driven and data-driven methodologies, drawing from economist Anthony Lee Zhang's framework. Idea-driven thinking originates from philosophical principles—market rationality or decentralization ethos—while data-driven analysis derives conclusions purely from empirical evidence.

Ideologies serve as critical scaffolding for complex decision-making, Vitalik argues. They foster community cohesion and mitigate overreliance on centralized leadership. Specialization flourishes when groups align around shared principles, enhancing operational efficiency.

The discourse underscores the necessity of balancing ideological conviction with pragmatic adaptation. Cryptocurrency ecosystems particularly benefit from this equilibrium—where Ethereum's roadmap reflects both ideological commitment to decentralization and data-informed protocol upgrades.

Arthur Hayes Doubles Down on Ethereum as Whales Accumulate Over $4 Billion in ETH

BitMEX co-founder Arthur Hayes has reversed his recent Ethereum sell-off with a $10.5 million repurchase, now pledging indefinite custody of ETH. This strategic pivot follows his $8.32 million profit-taking just seven days prior at $3,507 per token.

Whale activity shows institutional conviction, with over 1.035 million ETH ($4.17 billion) absorbed since July 10. The accumulation surge coincides with Hayes' public regret about his earlier exit, suggesting renewed institutional faith in Ethereum's long-term valuation.

Market attention is bifurcating between blue-chip assets like Ethereum and emerging presale projects such as Mutuum Finance. Hayes' macroeconomic warnings of potential $3,000 ETH appear superseded by this aggressive repositioning.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and institutional trends, BTCC's Robert projects the following ETH price forecasts:

| Year | Price Target (USDT) | Catalysts |

|---|---|---|

| 2025 | $5,210 - $7,000 | Institutional accumulation, ETF approvals |

| 2030 | $12,000 - $18,000 | Mass DeFi adoption, scalability solutions |

| 2035 | $25,000 - $40,000 | Web3 infrastructure dominance |

| 2040 | $50,000+ | Global reserve asset status |

Note: These estimates assume sustained network upgrades and regulatory clarity.